Letter of Credit: Traps Lite

L/C is abbreviation of English words “letter of credit”.

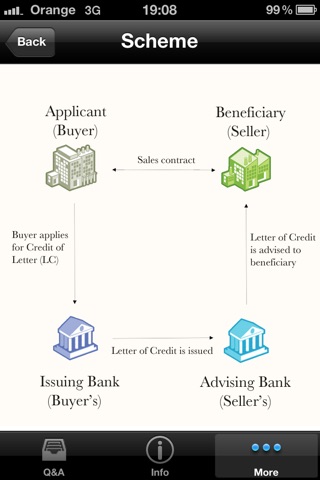

Letter of credit (L/C), also, documentary credit (D/C), is a well-known banking tool, which guarantees to the seller to receive a payment for sold goods without financial risks.

Against the buyer’s order the bank takes obligations within a certain period of time to pay to the seller cost of the goods after the seller presents to the bank the documents agreed with the buyer.

Although L/C is a reliable tool a businessmen in some cases may meet unexpected hindrances and traps, which will not allow the bank to fulfill the customer’s order.

It is very important to pay attention to the documents and the conditions listed in the buyer’s instruction to his bank.

The documents the importer (the buyer) requires in the credit usually include, at a minimum, a commercial invoice and clean bill of lading, but may also may comprise a certificate of origin, inspection certificate and other documents.

Knowledge of the answers of at least the listed below questions will help the businessmen to avoid many hindrances and possible traps they may meet when they deal with documentary credits.